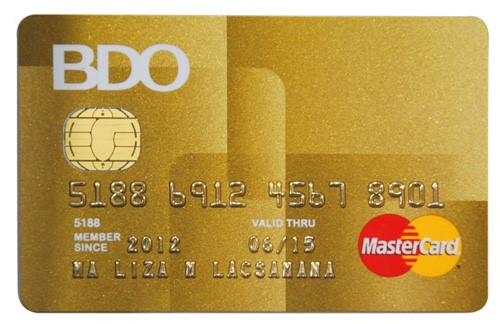

Zero-interest credit cards like bdo credit card can offer a valuable solution if you are attempting to pay back a cards with a higher interest rate. They will help you pay back debt faster and spend less on curiosity, help consolidate your regular card payments, or boost your available credit, thus enhancing your credit score. However, additionally, there are several reasons you might want to prevent a zero-interest credit cards altogether. Examine these potential pitfalls prior to making the switch.

- Balance Transfer Fees. Generally, when you execute a balance transfer, you’ll be at the mercy of a transfer fee, which may be between 3%-5% of the quantity transferred. This is often a hefty amount put into your total balance credited. But, compared to a high interest card, you may still finish up saving cash. You need to calculate your regular interest, just how much you would save with an intention free credit cards, and whether that’s more than the total amount transfer fee. There are several cards, nevertheless, that don’t possess a balance transfer fee. For instance, Chase Slate gives a 0% Intro APR on purchases and transfers of balance for 15 billing cycles, no intro stability transfer charge in the event that you transfer a stability within the first 60 days of account starting. So long as you pay off your personal debt within the intro period, you will put away lots of money on curiosity, and pay no costs on it, either.

- It Could Hurt Your Credit History. Trying to get any credit card can lead to a hard inquiry on your own credit file whether you are authorized for this or not, that may lead to your credit history going for a hit of somewhere within three and five factors. This implies that even though you aren’t accepted for the brand new credit cards, your credit history could decline. If you close the initial credit card after building the balance transfer, the common age of your accounts will drop. It will cause your total obtainable credit to diminish. These elements will negatively have an effect on your credit history. To combat these complications, simply keep carefully the original credit cards open (with a $0 balance), also after transferring the total amount from it. However, in the event that you will become tempted to invest money on the older credit card, after that it is advisable to just close it.

- It’s Only Temporary. Zero-interest offers are short-term and usually last between 6 to two years. You shouldn’t get more comfortable with this low APR since it will revert to an increased APR after the intro period is definitely up. When coming up with a stability transfer, it really is most essential to invest in paying off the total amount within the intro period. Otherwise, the interest begins accruing once again and it might be a waste of a chance to eliminate your debt completely.

- You Might Not Be eligible for 0%. Remember that you do not have a 0% promotional interest until you are approved for this. Receiving an online credit card applicationor pre-acceptance in the mail will not guarantee that you’ll obtain it. Also, a 0% balance transfer credit cards can’t help you if you get approved, however the credit limit onto it is indeed low that it can’t cover the total amount you wish. You’ll just finish up having two payments on a monthly basis rather than one. Always make absolutely sure to read carefully everything you are applying for. Transfers of balance aren’t always contained in promotional APR presents, so read the give to find if the 0% pertains to purchases and/or transfers of balance. Sometimes they only give 0% for just one, not the other.

- You May Not Have the ability to Transfer the total amount at All. Many issuers won’t allow a stability transfer from a different one of their cards. You will have to get a cards that isn’t released by the same lender as the cards you would like to transfer the total amount from. Here’s a set of the very best promotional balance transfer gives available.

- You Might Be Tempted to PAY JUST the Minimum. Many borrowers who open up a fresh zero-interest credit card will be tempted to pay just the minimum amount credited, instead of what these were paying on the original credit card. Because you have a lesser intro APR doesn’t imply you need to be paying any significantly less than you had been before. In fact, this is the time to repay the credit cards, when you don’t have to worry about interest, so ensure that you pay at least just as much as you were having to pay on the initial credit card.

- You Might Be Tempted to invest More. If you have trouble keeping credit cards open up without spending, you might not want to open up another card. Adding even more debt defeats the complete reason for opening a cards for a stability transfer, and can put you within a whole lot worse position than when you began. And occasionally the 0% doesn’t connect with new purchases, this means you’d instantly start accruing curiosity on any new buy you make. Therefore, the best matter you must do when starting a card for a balance transfer is never to add any new buys on that card.